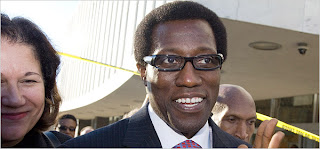

OCALA, Fla. — The actor Wesley Snipes was acquitted of the most serious charges against him on Friday in the most prominent tax prosecution since Leona Helmsley, the billionaire hotelier, was convicted of tax fraud in 1989.

Mr. Snipes was found not guilty on two felony charges of fraud and conspiracy. He was also acquitted on three misdemeanor charges of failing to file tax returns or to pay taxes, but was convicted on three others. He faces up to three years in prison.

Mr. Snipes had become an unlikely public face for the tax-denier movement, whose members maintain that Americans are not obligated to pay income taxes and that the government extracts taxes from its citizens illegally.

Two co-defendants — Eddie Ray Kahn, a promoter of tax denial, and Douglas Rosile, a disbarred accountant — were convicted on separate felony counts.

“The verdict shows that promoters face serious jail time” but clients who follow their advice will face a lesser but still-serious risk, said JJ MacNab, a Maryland insurance analyst who attended the trial and is writing a book about tax deniers.

Even as Congress has reduced income tax rates, the tax denier movement has spread, fueled by high payroll taxes, political attacks on the Internal Revenue Service and anger among people who have not benefited from decades of strong overall economic growth.

Instead of prosecuting all offenders, the Justice Department brings cases against well-known individuals, hoping that widespread news coverage will encourage compliance, a policy known as general deterrence.

Tax deniers assert variously that the tax laws are valid but do not apply to them, that no law makes anyone liable for taxes and that the government tricks people into paying. Promoters of tax denial claim that people can legally stop paying income taxes by executing certain documents, or by not signing others, such as tax returns. Courts have rejected all of these arguments.

Mr. Snipes, 45, was indicted in October 2006 on two felony charges: fraud for filing a false claim for a $7 million refund (of taxes paid in 1997, before he stoped paying taxes), and conspiracy with his two co-defendants to defraud the government.

Mr. Snipes was also charged with six misdemeanor counts of failing to file tax returns or to pay taxes on at least $58 million he and his film company earned from 1999 to 2004.

Since 1986, Mr. Snipes had appeared in more than 50 films, earning at least $103 million, court papers showed.

Mr. Snipes has built a huge following, especially overseas, with his portrayals of intrepid detectives and fearless vampire slayers and occasional comedic roles. In addition to the “Blade” trilogy of vampire movies, he starred in action films like “Drop Zone” and “The Art of War” and, with Sean Connery, the corporate crime thriller “Rising Sun.”

The defense rested on Monday without calling any witnesses. The prosecution presented its case over seven days.

In closing arguments on Tuesday, lawyers for Mr. Snipes sought to portray him as a well-intended victim of bad advice by his co-defendants. They called his tax theories “kooky,” “crazy” and “dead wrong,” but said acting on these views did not make him a criminal because he disclosed his actions. The defense also objected to his being tried by an all-white jury of seven women and five men.

The Supreme Court has ruled that tax deniers can demonstrate the absence of criminal intent by asserting that they “sincerely believe” that they are not required to pay taxes, although they cannot escape the levies.

Prosecutors argued that Mr. Snipes showed criminal intent when he sent the government three bogus checks to pay $14 million in taxes and an amended tax return that was subtly altered with software to state that he filed under “no” penalty of perjury.

Defense lawyers said Mr. Snipes did not file tax returns after his indictment because the I.R.S., by making him the target of a criminal investigation, “forced” him to exercise his right to remain silent.

After his indictment, however, Mr. Snipes sent the government a series of rambling letters describing his tax theories and warning that “pursuit of such a high-profile target will open the door to your increased collateral risk.”

Robert E. O’Neill, the United States attorney prosecuting the case, called the filings “gibberish” whose sole purpose was to thwart law enforcement.

In one 600-page document, Mr. Snipes said he was legally a “nontaxpayer” and the tax laws did not apply to him because he was not a resident of the District of Columbia, was not a federal official and was not engaged in any trade or business, all common tax denier arguments.

Mr. Snipes also complained that the I.R.S. violated his 14th Amendment rights to equal protection because it would not help him establish what he said was his rightful status as a legal nontaxpayer.

Kenneth I. Starr, a New York accountant who had long prepared Mr. Snipes’s tax returns, testified that he dropped Mr. Snipes as a client after he refused to pay taxes. Defense lawyers tried to attack Mr. Starr’s credibility, portraying him as dishonest and the target of a grand jury inquiry — accusations that Mr. Starr rebutted by pointing out that he was a witness before the grand jury, not its target.

The lead lawyer among the six representing Mr. Snipes, Robert G. Bernhoft of Milwaukee, has been under a federal court order since 1999 barring him from selling materials that supposedly relieve people of the need to pay taxes.

Mr. Snipes joined the tax denier movement after becoming upset when told that his 1999 income tax would be more than $2 million, Carmen Baker, his former assistant, testified.

A mutual acquaintance introduced Mr. Snipes to one of his co-defendants, Mr. Kahn. Mr. Kahn operated a Christian ministry, the Guiding Light of God Ministries, and a central Florida company called the American Rights Litigators that sold “nonenforcement pocket commissions” and other papers that were supposed to legally stop I.R.S. agents from collecting taxes.

Employees of the ministry and the company used fake names and were paid in cash, the court was told . One former employee testified that she came to realize Mr. Kahn (pronounced kane) was not a tax expert, but a scam artist.

After Mr. Kahn held a seminar in Mr. Snipes’s California home, the actor told associates that he would no longer pay taxes and would no longer withhold taxes from paychecks of his Amen Ra Films employees, whom he barred from paying taxes.

Ms. Baker, Mr. Snipes’s former assistant, testified that when she expressed doubt about Mr. Kahn’s claims, her job was threatened, she was sent out of the room and her notes and copies of Mr. Kahn’s literature were confiscated.

From 1998 through 2003, Mr. Kahn charged more than 2,000 clients up to $1,550 each to file bogus misconduct complaints against I.R.S. agents, part of what the Justice Department said in another case was a scheme to hobble tax law enforcement.

When Mr. Snipes formed a new company, Kimberlyte Productions, Ms. Baker’s signature was forged on documents identifying her as president, according to trial testimony. Because of her job title, federal law made Ms. Baker personally liable for any taxes not withheld from employee paychecks.

Mr. Kahn, who was imprisoned for tax crimes in 1985 to 1987, fled to Panama after the 2006 indictment. . He was extradited to stand trial on the latest charges but refused to attend the proceedings, remaining in his jail cell, after telling Judge Hodges that the court had no authority over him. Mr. Snipes and Mr. Rosile are free on bail.

Last year Congress passed a law drafted by Ms. MacNab empowering the Internal Revenue Service to impose $5,000 fines on people who assert tax denier claims not just in court, but also in papers sent to the agency. The law gives tax deniers one opportunity to withdraw the papers after the agency sends them a list of tax denier theories rejected by the courts.

Ms. MacNab reiterated her recommendation to Congress that it define the concept of willfulness so that people who ignore the advice of competent tax professionals in favor of what scam artists tell them cannot claim they seriously believe that the tax laws do not apply to their income.

The Snipes case is the fourth significant loss by Justice Department prosecutors who brought felony charges against people who were leading figures in the tax denier movement.

Mr. O’Neil, the prosecutor, was asked whether Congress needs to revise the tax laws to deal with people who follow scam artists.

“Absolutely,” he replied, directly contradicting the Justice Department’s written recommendation to Congress. Mr. O’Neil said the current standard “is entirely subjective” and results in acquittals by juries even when they are presented with what he considers unreasonable conduct by defendants.

No comments:

Post a Comment